Top 5 Reasons to Study Artificial Intelligence

5 Reasons Why Study Artificial Intelligence:

Come on ! you are wrong About the Coming AI Revolution or lets see:

The technology behind artificial intelligence and deep learning is intriguing. But what fascinates me is how AI algorithms and applications force us to rethink everything we know about the meaning and purpose of life and work.

Here are just some questions that I have discussed with colleagues and students in the last week:

How will AI change our understanding of privacy?

How will AI affect our perceptions of “ownership”?

What is the best response to the exponential growth of AI?

This story explores the last of these questions by focusing on the example of Fintech.

Not Everyone Feels the Same Way

Artificial intelligence, machine learning and deep learning are doing something that once seemed unthinkable. They are transforming heavily regulated industries, such as the “financial services and trading industry” or the “healthcare and life sciences industry”.

What is interesting, however, is that “insiders” in these industries seem to react in very different ways to the arrival of these new and disruptive technologies.

Take healthcare and life sciences.

Artificial intelligence takes the role of an experienced clinical assistant who helps doctors make faster and more reliable diagnoses. We already see AI applications in the areas of imaging and diagnostics, and oncology.

Machine learning has the potential to improve remote patient monitoring. AI algorithms are able to take information from electronic health records, prescriptions, insurance records and even wearable sensor devices to design a personalized treatment plan for patients.

These AI-related technologies accelerate the discovery and creation of new medicines and drugs.

There is a broad consensus amongst insiders that healthcare is being transformed for the better as a result of AI. The opportunities and potential are limitless.

Healthcare is going to be one of those industries that is elevated and made better by machine learning and artificial intelligence.

Similarly, new technology is disrupting the financial services sector. Fintech — broadly defined as the use of new technologies to make financial services, ranging from online lending to digital currencies, more efficient — can be seen across a range of financial services. For example:

· Peer-to-peer lending platforms that use algorithms and machine learning to assess the creditworthiness of borrowers.

· “Robo-advisors” that have the potential to automate personal finance and wealth management. They can help individuals manage their personal accounts, debts, assets and investments.

And yet, in contrast to the health care sector, it appears that most incumbents in financial services take a more cautious or even sceptical view about the possibilities and prospects of this technology.

While the healthcare industry is generally convinced that artificial intelligence, machine learning and deep learning will improve the quality of healthcare and transform the industry, this view is not so widely shared among traditional bankers and other finance professionals and consultants, such as accountants.

This resistance to the potential benefits of new technologies occurs, in spite of the fact that technology is transforming the industry.

AI in the Financial Industry

The most important reason for the “resistance” seems to be the emphasis that financial insiders place on the human or emotional aspects of their services.

Financial service providers like to emphasize how finance and wealth management is a profession rooted in a personal approach to dealing with clients. An experienced and knowledgeable advisor understands the relationship with his/her client as a deep, on-going and dynamic process.

According to this view, it is important for clients to know that they have entrusted their money with a real person who understands human emotions and believes that investment and financial services is much more than just portfolio optimization.

Against this background, it is easy to deny the potential benefits of a cold and calculating machine intelligence. Machines lack the human empathy and emotional understanding that are seen by insiders as a crucial element of the service that they provide.

Even with great attention to learning the emotional strengths and limitations of clients, we still are highly imperfect, so how likely is it that even the best AI model will achieve results that are both dependable and reliable?

This more sceptical view of the potential of AI and automation in a financial services context does not completely deny the role of technology. Everyone accepts that computer algorithms have a place in the investment process. But this role is “limited”; technology is a supporting device in the hands of an emotionally intuitive human advisor.

This is precisely the reason that the recent slew of interest in robo-advisors (automated investment solutions) isn’t a big concern for me. At its best, technology can assist the implementation of a strategy, not its purpose or relevance.

Moreover, this more cautious view about the prospects of Fintech seems to be supported by the fate of start-up companies in the Fintech sector. Such companies have received enormous amounts of investment, but have often had difficulties in scaling. High profile examples are Betterment and WealthFront.

In trying to understand why it has proven so difficult to scale AI-based Fintech start-ups, scepticism is perhaps the most important reason.

Many financial professionals appear to believe that artificial intelligence is science fiction that doesn’t need proper attention for the next ten years. And even then, its implementation and integration in our daily lives will be hampered by regulatory challenges, fear and costs.

The emotional and human aspects of financial services are again often mentioned in this context. According to some studies, it has been suggested that people are unlikely to use a purely automated financial advising system in the foreseeable future.

There is some empirical evidence to support this claim.

According to a GfK survey, only 10% of all participants said they would be likely to trust a computer algorithm more than a human to give them financial advice. 50% of the participants disagreed with this statement. 45% said they would not be willing to forego live customer service in return for paying less. Across a diverse range of financial products, consumers are least open to completely automated customer service for high impact investments and personal mortgages.

This emphasis on the meaning of financial services, both for the client and the provider should not be dismissed lightly. It clearly influences much of the thinking and discussion in the field.

No doubt there are some issues to be overcome, but here are five reasons why this sceptical view of AI-based Fintech is wrong.

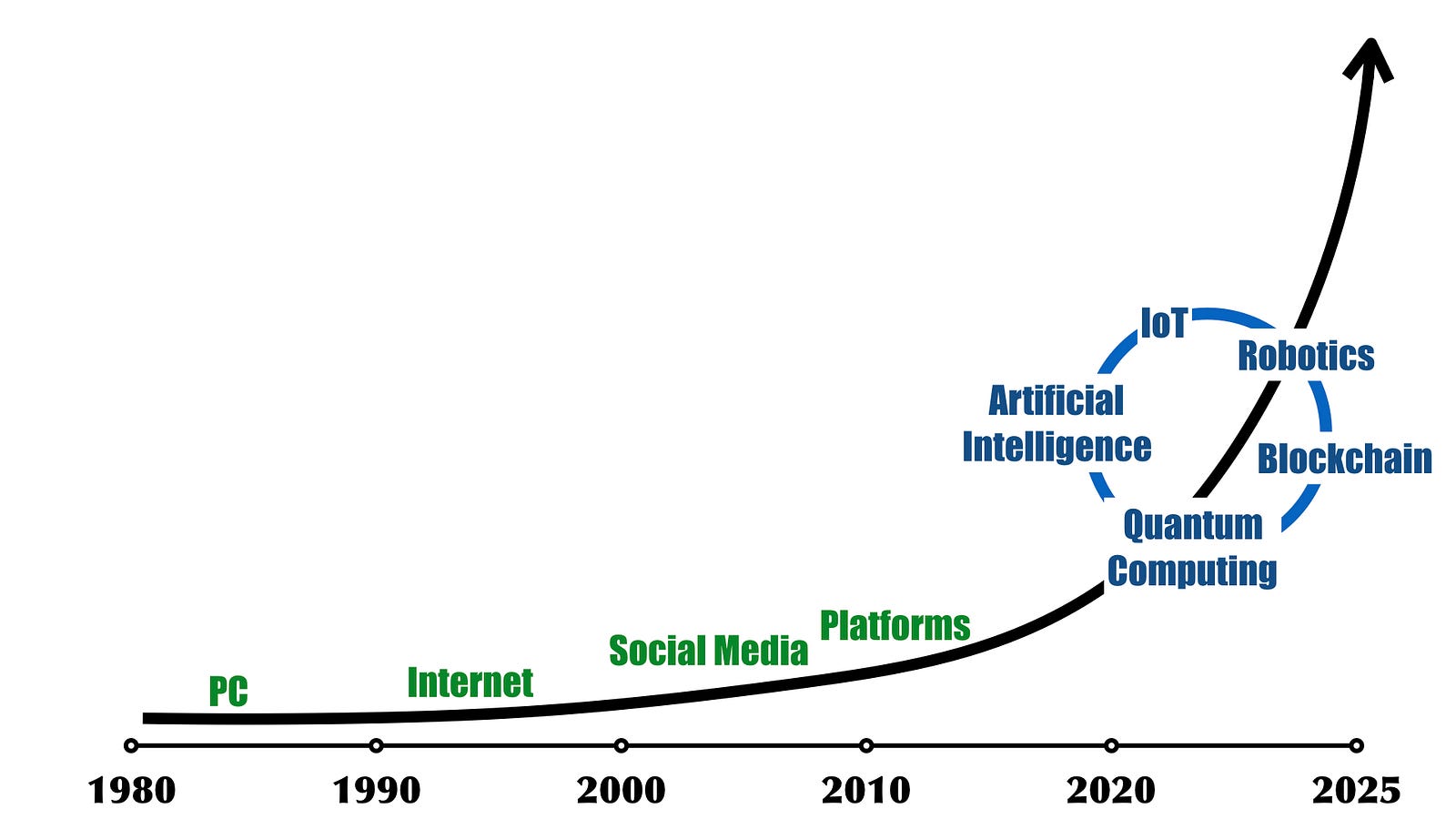

(1) The exponential growth of disruptive technologies that accelerate each other

The speed of technological development means that transformative change will come much sooner than expected.

Big data and the near-endless amounts of information undoubtedly transformed AI to unprecedented levels. Blockchain technology and smart contracts will merely continue the trend.

The enormous increase in computational power, the breakthrough of “Internet of Things” applications and the further development of smart machines will only accelerate AI’s development and global adoption.

The increasing acceleration of innovation will add to AI’s ability to adapt to new situations and solve problems that currently seem to be impossible.

(2) The need for “humanity” in financial services as self-serving deceit

Bankers, financial services providers and their consultants often use the “personal” aspects (particularly, the understanding of human emotions) as the main argument against the wide adoption of AI, machine learning and deep learning in the industry.

Ironically, however, the emphasis on the meaning and the human aspects of financial services can come across as arrogant and self-serving. The characterization of finance as deceitful, infamous, and vulgar still rings true today — particularly in the wake of the 2008 financial crisis.

“Arrogant” bankers and financial professionals, engaging in a produced performance that is not authentic, makes me sceptical about their dismissal of AI and smart machines. The hierarchical organization and structure of banks appears to be an important reason for the “impersonal”, time-consuming and cumbersome interaction with bankers and their consultants.

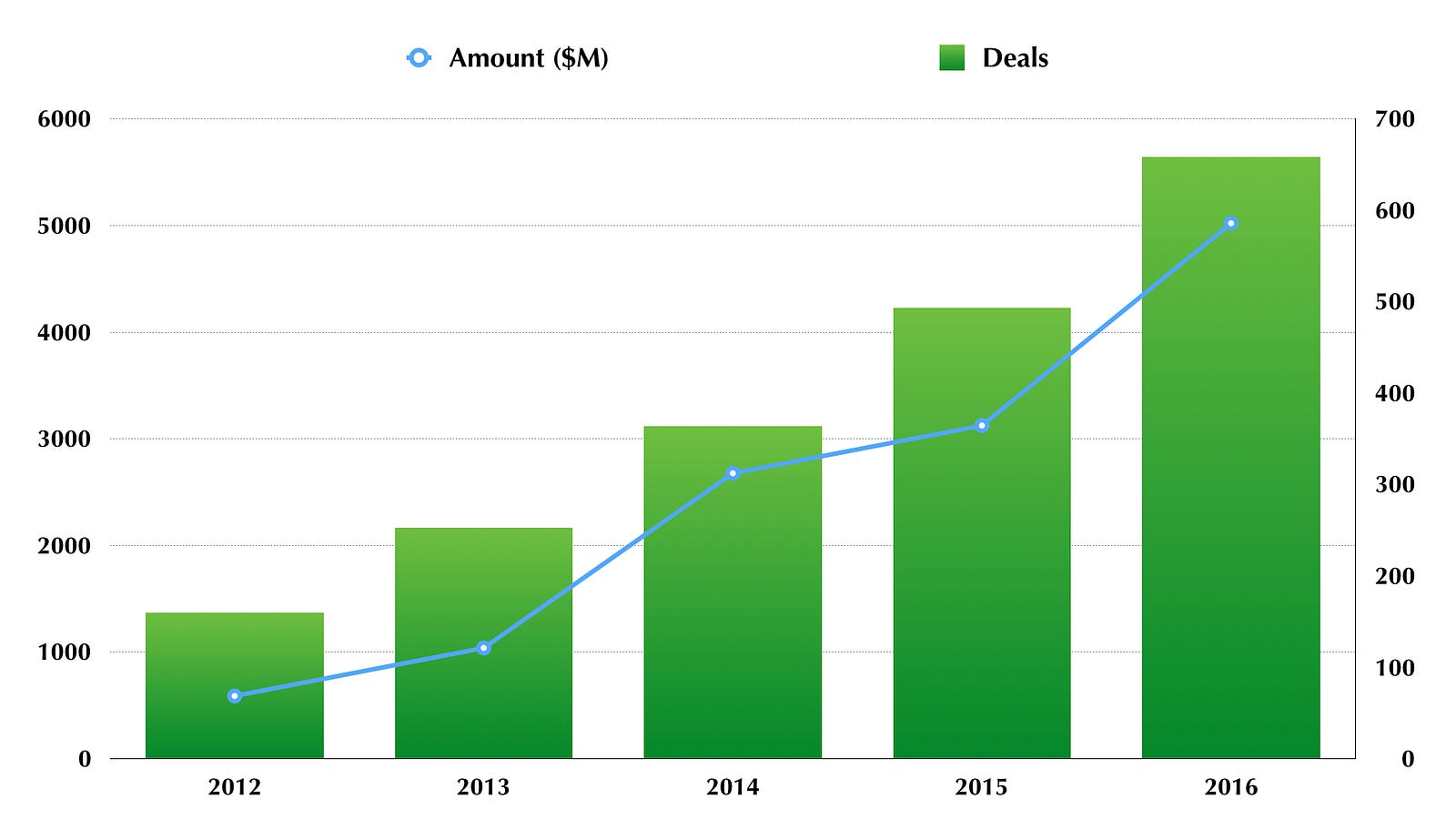

(3) Funding in new technologies reaches “record” levels

The flat hierarchy and “peer-to-peer” opportunities offered by innovative start-up companies in the financial industry give them a tremendous advantage over traditional banks.

Innovative artificial intelligent applications (that have the potential to reduce the need for trained professionals) will only facilitate “peer-to-peer transactions.

The AI In Fintech Market Map: 100+ Companies Using AI Algorithms To Improve The Fin Services…

www.cbinsights.com

www.cbinsights.com

The fact that smart innovators continue to attract record amounts of money usually means something big is happening. This is just another reason why we cannot ignore artificial intelligence in the financial industry.

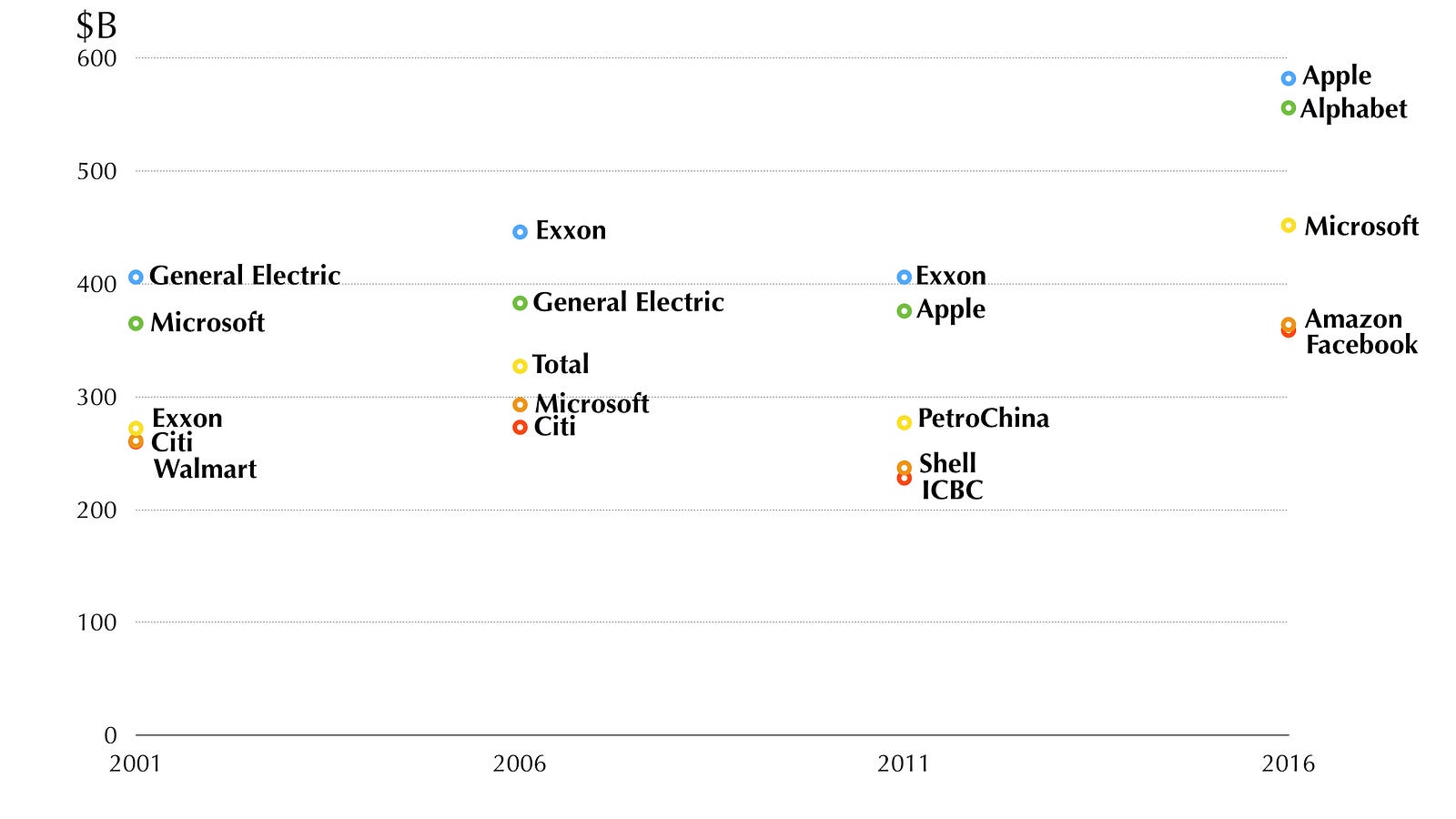

(4) Artificial Intelligence and algorithms are hot

Companies that are algorithmically based and embrace AI are the darlings of consumers and popular culture.

Siri (Apple), Google Assistant (Alphabet), Cortana (Microsoft) and Alexa (Amazon) are currently ready to assist you with more and more difficult tasks.

Artificial intelligence, machine learning, deep learning are just the beginning of a revolution that will transform everyday life and how we interact with technology.

Investors and consumers value the companies that embrace these new technologies and gradually bring them to the market. It is thus no surprise that Apple, Alphabet, Microsoft and Amazon have recently replaced the traditional financial institutions (and oil businesses) as the largest companies in the world, at least according to their market capitalization.

These companies view different types of Artificial Intelligence as the most important business opportunity for the future.

(5) Disruption doesn’t need “Westworld” — type AI

In thinking about intelligent machines, it is helpful to distinguish between four types of AI:

· Type 1 AI refers to reactive machines that specialize in one area. For instance, the drafting and review of commercial loan agreements.

More “famous” examples are IBM’s Deep Blue chess software or Google’s AlphaGo algorithm that was too strong for the best players of the board game of Go.

· Type 2 AI machines possess just enough memory or “experience” to make proper decisions and execute appropriate actions in specific situations or contexts.

Self-driving cars, chat bots, or personal digital assistants are the most commonly used examples.

· Type 3 AI has the capacity to understand thoughts and emotions which affect human behaviour.

Softbank Robotic’s “Pepper” can organize large amounts of data and information to have a “human-like” conversation.

· Type 4 AI as it is typically portrayed in Hollywood movies or TV shows. Machines using this type of AI are self-aware, super intelligent, sentient and conscious. Think Westworld.

The key point here is that sceptics of Fintech (and artificial intelligence) in the financial services industry think that until we have Type 4 AI — AI that is more human than human — we cannot fully trust or rely on the technology.

But this view is based on a misconception. There are many tasks that are central to financial services that are already performed by machines. Type 1 AI can do certain things more effectively than a human (for instance, reviewing standard form contracts). Type 4 AI is a long way off, but that doesn’t mean that the financial services industry can’t be radically disrupted by the other, simpler, forms of machine intelligence.

How to respond?

We must study artificial intelligence, machine learning, and deep learning technology, as well as their applications.

Yes, we are perhaps still in the development stage, but the various technological and security issues surrounding these new technologies will soon be solved. And solutions will be accelerated by the development of other related technologies.

To dismiss the arrival of industry-transforming technology seems to go against everything that we know about technological change in the digital world.

And, the recommendation to study and understand AI is not only for technologists, mathematicians and computer scientists. Everybody should engage with these developments.

Though some have voiced concerns about artificial intelligence, it’s actually leading us to a very different future than what we’re currently experiencing.

We should not continue to rely on old ideas, principles, concepts and experiences. We must study the new world in order to remain relevant and to develop a better understanding of the new digital reality that is emerging around us.

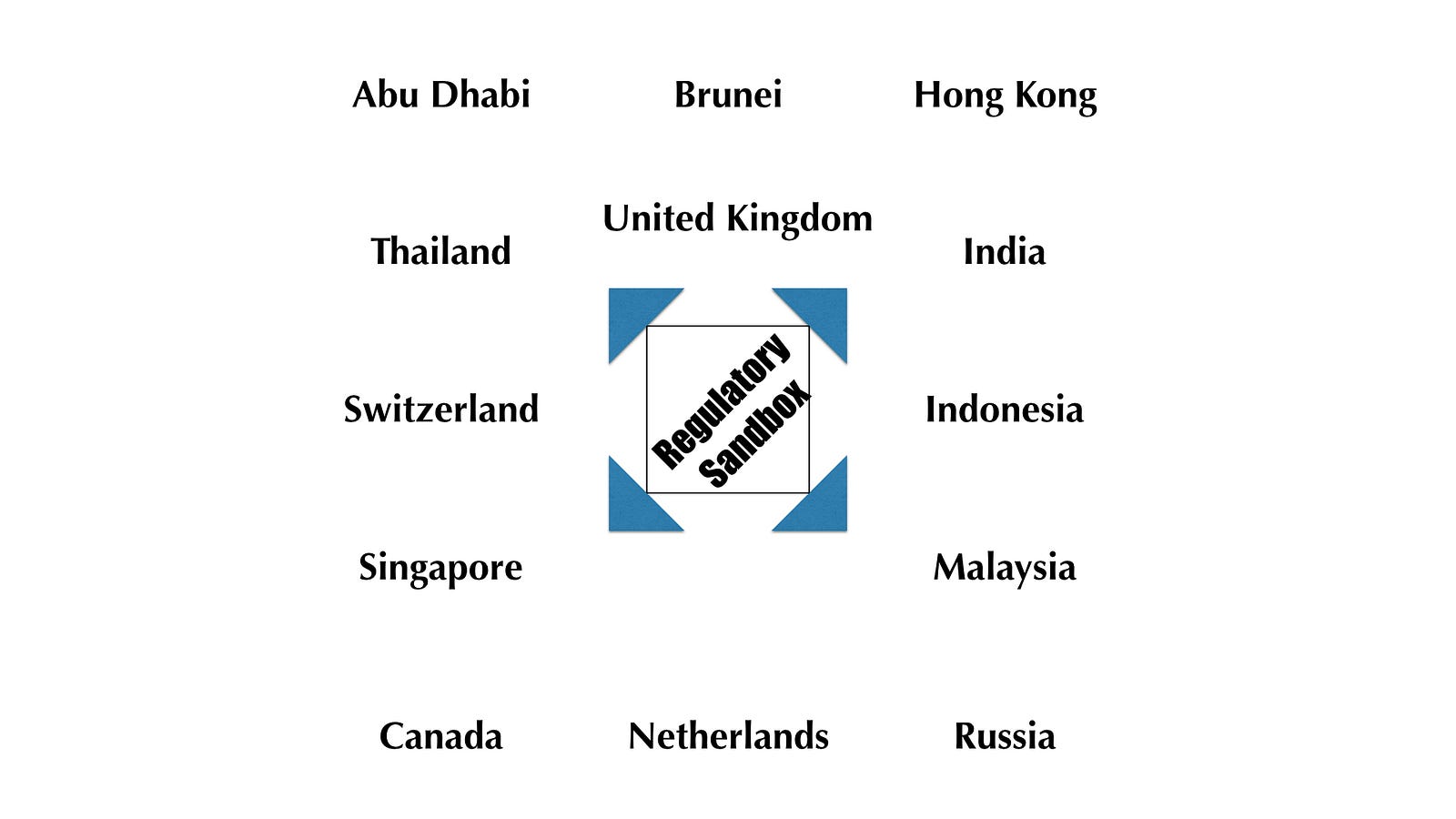

In the financial industry, this engaged-approach with disruptive technology is best facilitated by the establishment of “regulatory sandboxes”

In April 2016, the UK Financial Conduct Authority broke new ground by announcing the introduction for a “regulatory sandbox” which allows both start-up and established companies to experiment with and test new ideas, products and business models in the area of Fintech.

Of course, the set-up of the “regulatory laboratory” comes with restrictions in time and number of users. Still, the idea was rapidly followed by other jurisdictions that desire to promote innovation by allowing new technologies, products and services to be developed and tested in a supervised and safe environment.

In discussions about regulatory sandboxes with other experts in banking and finance, I have heard arguments that their deployment is nothing more than a strategy of a country to signal its openness to innovation and technology.

In their view, “sandboxes” aren’t offering anything new. Regulators are usually able to exempt companies and technologies to comply with the applicable set of rules and regulations without referring them to the sandbox. The Australian “Fintech” exemption is an example.

Yet, these arguments seem to miss the main advantages of the “regulatory sandbox”.

What makes these initiatives so attractive is not the mere fact that the regulator encourages technological innovation by lowering regulatory barriers (and costs for testing disruptive innovative technologies).

The potential of regulatory sandboxes goes much further than this.

Insofar as technology has consequences that flow into everyday lives, such technology will be open to discussion and democratic supervision and control. In this way, public entitlement to participate in regulatory debates can help to create a renewed sense of legitimacy that justifies the regulation.

What is even more important is that regulatory sandboxes offer opportunities to generate information and data relevant for the regulation of the new digital world. They allow the participants in the sandbox, i.e., regulators, incumbent companies, start-ups, investors, consumers, to learn about the new technologies (such as AI).

They can create the necessary dialogue that helps us understand new technologies.

They allow for collaboration and joint discovery.

But perhaps most importantly, they create an opportunity to change the mind-set of incumbents operating in the financial service sector and allow them to embrace the new possibilities associated with artificial intelligence, machine learning and deep learning.

Comments

Post a Comment